By Bonddad

bonddad@prodigy.net

Today's Paul Krugman writes an essay in the NY Times arguing that the Democrats should not try and fix the deficit. While is argument is clear and cogent, it is also 100% wrong. Below I will explain why.

Here is a link to the editorial

Now that the Democrats have regained some power, they have to decide what to do. One of the biggest questions is whether the party should return to Rubinomics — the doctrine, associated with former Treasury Secretary Robert Rubin, that placed a very high priority on reducing the budget deficit.

The answer, I believe, is no. Mr. Rubin was one of the ablest Treasury secretaries in American history. But it’s now clear that while Rubinomics made sense in terms of pure economics, it failed to take account of the ugly realities of contemporary American politics.

And the lesson of the last six years is that the Democrats shouldn’t spend political capital trying to bring the deficit down. They should refrain from actions that make the deficit worse. But given a choice between cutting the deficit and spending more on good things like health care reform, they should choose the spending.

....

But the realities of American politics ensured that it was all for naught. The second President Bush quickly squandered the surplus on tax cuts that heavily favored the wealthy, then plunged the budget deep into deficit by cutting taxes on dividends and capital gains even as he took the country into a disastrous war. And you can even argue that Mr. Rubin’s surplus was a bad thing, because it greased the rails for Mr. Bush’s irresponsibility.

As Brad DeLong, a Berkeley economist who served in the Clinton administration, recently wrote on his influential blog: "Rubin and us spearcarriers moved heaven and earth to restore fiscal balance to the American government in order to raise the rate of economic growth. But what we turned out to have done, in the end, was to enable George W. Bush

.....

With the benefit of hindsight, it’s clear that conservatives who claimed to care about deficits when Democrats were in power never meant it. Let’s not forget how Alan Greenspan, who posed as the high priest of fiscal rectitude as long as Bill Clinton was in the White House, became an apologist for tax cuts — even in the face of budget deficits — once a Republican took up residence.

I understand what Krugman is saying -- by actually balancing the budget the Democrats would allow another Bush to come in and screw things up.

While I am sympathetic to that argument from a political perspective, I am completely opposed to it from a policy perspective for several reasons.

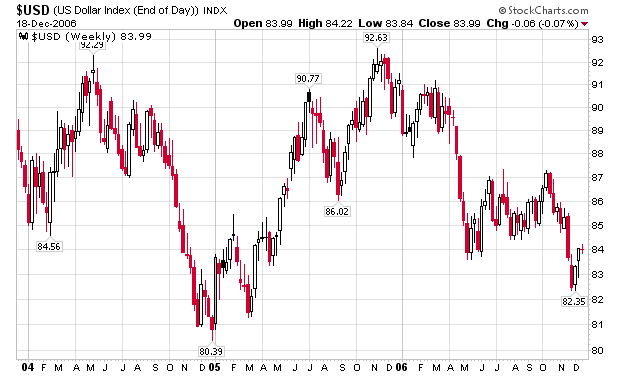

1.) The dollar is approaching multi-year years. While there are several reasons for this, the lack of fiscal discipline in Washington is one reason. Restoring fiscal discipline to Washington will help to bolster the dollar. Here is a recent chart of the dollar to illustrate what I am talking about.

2.) According to the Bureau of Public Debt, the US has issued over $550 billion dollars of net new debt each year for the last 4 years. The debt/GDP ratio now stands at over 60% of GDP. Simply maintaining that pace under a "do not harm" governing strategy will increase the burden on future generations. In addition, if we don't start addressing this issue now, it could spiral out of control and get to the point where it addresses us.

3.) It would increase the market's confidence. Corporations have a ton of cash on their balance sheet right now. However, they aren't spending it. That leads to the question of why? One of the reasons is the uncertainty to the current economic situation. Businesses look to the Federal government and see a mess. They know that eventually someone will have to clean it up. And that means tax increases and spending cuts. As a result, businesses are shoring up their balance sheets for that possibility. Balancing the budget will free up these balance sheets for more domestic investment.

4.) The end of crowding out. In line with 2 and 3 above, the net new issuance of debt means there is over $550 billion in money invested in government bonds that could be invested in the domestic economy. The US economy desperately needs this money.

Update [2006-12-22 9:37:19 by bonddad]:: I wrote the preceding in a fit of pique, so I left a few things out.

5.) Krugman wrote that Dems should spend on things like health care, etc... That's a good idea. But -- where is the money for that going to come from? Thanks to Bush's policies we are in debt. There ain't any money there.

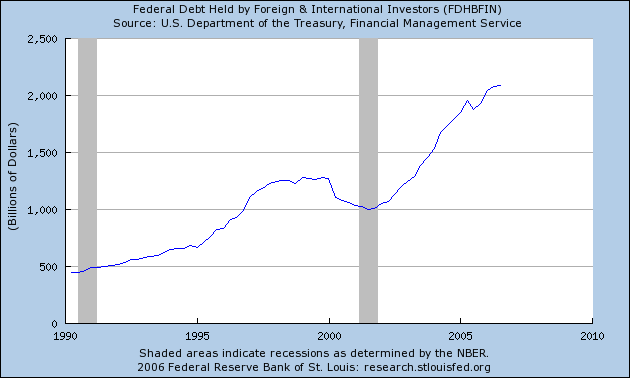

6.) As the chart below indicates, the US is more and more obligated to foreign holders of US debt. Some of this is the result of the trade deficit. However, thanks to the budget deficit, the US is floating lots of debt as well.

7.) The entire US system is currently based on a "rentier" system. Because the US floats all this debt, it has to create a tax system that promotes debt. Hence -- the need to cut capital gains taxes and income taxes on upper-income individuals. After these taxes get cut, the US is more able to promote the "borrow and squander" theory of budgeting. Until we dry up the supply of debt, politicians will be more likely to promote the current system.

While I respect Krugman's intellect and ability, here he is simply wrong.

For market and quick hit economic commentary, go to the Bonddad Blog

No comments:

Post a Comment