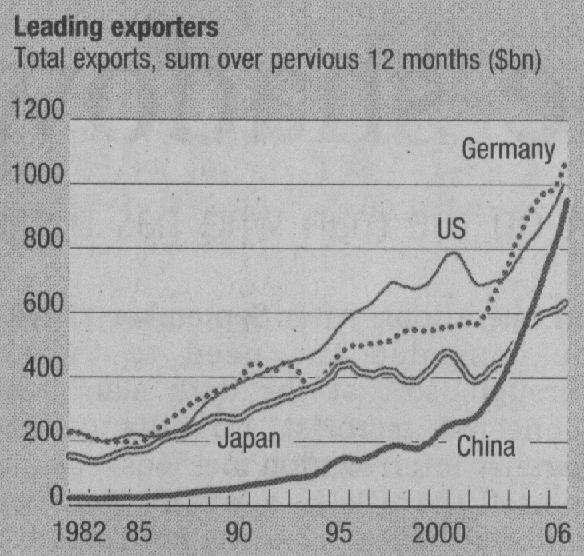

Nothing shows how globalisation has accelerated at the turn of the century than this graph showing the exports of the 4 biggest exporters: Germany, the USA, China and Japan:

The staggering increase in Chinese exports is all too visible, but the performance of German exporters over the past few years is also quite notable, and the USA and Japan have also enjoyed record export growth.

Trade, free or not, is certainly doing well.

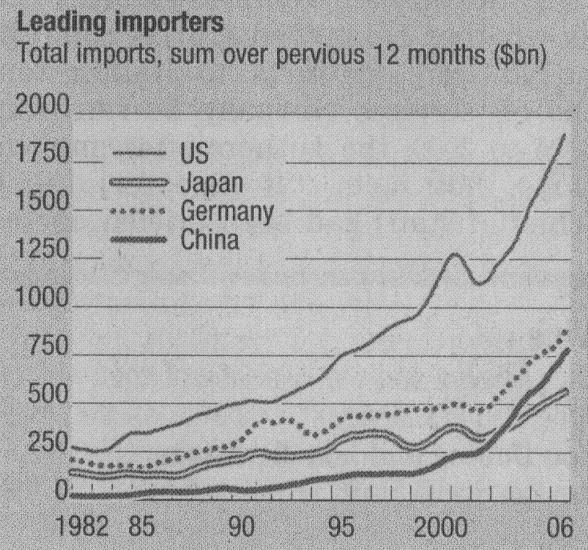

But of course, exports have a flip side - imports.

And the picture here is a bit different:

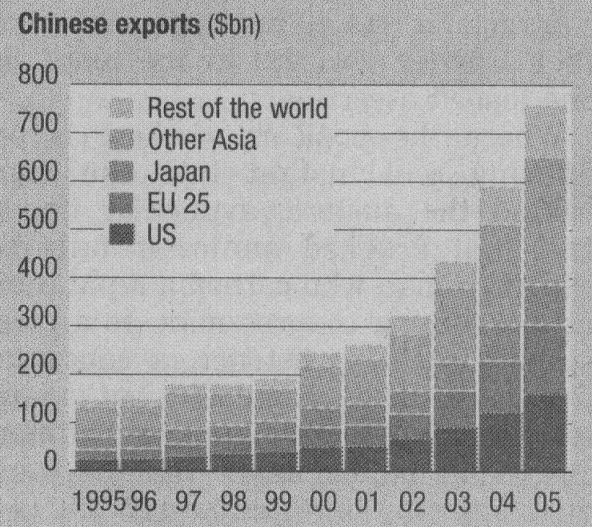

Germany, Japan and China show significant increases in imports that roughly match their exports. All 3 have healthy surpluses, but the evolution of imports and exports seem correlated. German companies increasingly outsource to Eastern Europe components or sub-assembly, and export the final product, including the "Made in Germany" stamp and implicit or explicit quality check. Same thing with Japanese companies with China or the rest of Asia playing the subcontracting role. There is a debate as to what portion of the value added stays in the country, but it seems that ultimate control is still firmly with the German of Japanese companies. In the case of China, there is a lot of imports of raw materials, and also important of components for assembly and re-export. The graph below, which shows that China actually exports a lot more to Japan and Asia (with which it has trade deficits) than to the US or Europe suggests that China is also increasingly integrated in the regional economy, probably focusing on commoditised goods, either sold on directly to final markets or to other Asian countries for further value addition.

The really odd case is that of the USA. While the above 3 export about 20% more than they import, the USA import a staggering 90% more than they export, which means that their trade deficit is almost equal to their total exports.

So it's not that the USA is not exporting, or that its manufacturing based is hollowing out (the value of industrial production is reaching record levels), it's just that (i) it requires a lot fewer jobs to do so, and (ii) its growth outside the export sector has been a lot slower than that of the rest of the economy, and thus its relative share is declining. And of course that exports are overshadowed by massive imports, themselves fuelled by record debt-driven consumption.

And the problem is not so much imports from Asia (although they do add up, and are growing), but the combination of these with an increasing oil bill.

Meanwhile, strip out exports to the US, and China, Germany and Japan are not so far from balancing their trade. Notably, Europe (led by Germany) is able to balance its trade with OPEC, something the USA is conspicuously failing to do.

Which brings us to the dollar.

We have a combination of two economic trends, globalisation and higher commodity prices, the second one being lead by the first one:

- globalisation driven by the lure of lower labor costs and the ease of movement of capital has increased offshoring and outsourcing to places like China. That movement is led by large Western companies which move their factories to lower cost (and lower regulation) environments but keep their headquarters, strategic product control - and a large portion of their clients - in the rich world. The locals also benefit to some extent, and are busy building their infrastructure and enjoying the first fruits of prosperity, at least for significant minorities in each country.

- most other countries, to adapt to that relentless trend, have to cut costs to stay competitive, which has translated, in rich countries, in income stagnation, lowish growth driven by weak consumption, but higher corporate profits;

- the USA is in a different position. Thanks to the dominant role of the dollar, and its own status as the largest economy, there has been no need for a domestic contraction to remain competitive: consumption, and growth, is fed by debt, which is being granted freely by the rest of the world, and allows US consumers to keep on buying despite suffering from the same downward pressures on wages and income. US corporates get the best of both worlds: buoyant demand and lower costs - and thus a boost to profits, all thanks to Uncle Sam's global credit card.

- this mechanism depends, of course, on others being willing to lend the USA money. The mercantilist Asian economies did, for a while, (as it protects their own competitivity) but they have slowed down their net purchases. Thankfully, a new player has come to the fore: oil exporters, who have benefitted from the price spikes created by the strong world growth generated by the above cycle, and are accumulating record trade surpluses - mostly, when imports are taken into account, with the USA. Flush with dollars, they have lent these amounts again, and allowed the merry dance to go on further than anyone believed.

But this may come to an end soon. Oil producers are beginning to move away from the dollar.

Oil producing countries have reduced their exposure to the dollar to the lowest level in two years and shifted oil income into euros, yen and sterling, according to new data from the Bank for International Settlements.

The revelation in the latest BIS quarterly review, published on Monday, confirms market speculation about a move out of dollars and could put new pressure on the ailing US currency.

(...)

Russia and the members of the Organisation of the Petroleum Exporting Countries, the oil cartel, cut their dollar holdings from 67 per cent in the first quarter to 65 per cent in the second.

Meanwhile, they increased their holdings of euros from 20 to 22 per cent, the BIS said. The speed of the shift may help to explain the weakness of the dollar, which recently fell to a 20-month low against the euro and a 14-year low against sterling.

(...)

The review shows that Qatar and Iran, whose foreign exchange policy has sparked widespread market speculation, cut their dollar holdings by $2.4bn and $4bn respectively.

(...)

The last time oil-exporting countries cut their exposure to the dollar – in late 2003 – it pushed the euro to an all-time high against the dollar. Eighteen months ago, the exposure to the dollar of oil producing countries was above 70 per cent.

(...)

The rise in oil prices since 2002 means oil producing countries have amassed a current account surplus of about $500bn, according to the IMF. This is 2½ times the current account surplus of China.

Overall, Opec’s dollar deposits fell by $5.3bn, while euro and yen-denominated deposits rose $2.8bn and $3.8bn, respectively. Placements of dollars by Russians rose by $5bn, but most of their $16bn additional deposits were denominated in euros.

The dollar has suffered weakness because of concerns about global imbalances and the future course of the Federal Reserve’s interest rate policy.

And as, currently, the USA need to borrow $2.5 billion per day just to stay afloat, any slowing down in the rythm of purchases of US debt, let alone net sales, will have a direct impact on the rate of the dollar and the overall cycle described above.

It appears inevitable to me that this cycle will have to stop at some point, and it is likely that it is going to take the form of a collapse of the dollar, a collapse of US demand, and a brutal contraction of the export-driven economies of various bits of the world.

How this will play out is, to say the least, uncertain, but the ride is unlikely to not be rough for most parts of the world.

And the countries that hold the cards, beyond China (which has already slowed down on its dollar purchases and is prevented from doing anything rash by its own interest not to rock the boat so as not to threaten the competitivity of its exports) are Russia and Saudi Arabia. Russia is already diverting away from the dollar to a large extent (two thirds of its reserve increase is not dollars), which leaves Saudi Arabia, and its Persian Gulf neighbors, as the last remaining major buyer of dollars or dollar-denominated debt instruments.

Gee, they sure seem to come up often in the news. No wonder they are they getting assertive in Iraq - they effectively hold the US economy hostage today.

Jerome a Paris, France

Email: jeromeguillet@yahoo.fr

Energy banker based, yes, in Paris, France. Writing about energy, economics, international geopolitics, European and French stuff, and whatever else catches my attention. Very strongly pro-European. Liberal in the US, libéral in France and proud of both.

1 comment:

"No wonder they are they getting assertive in Iraq - they effectively hold the US economy hostage today."

THEY LIVE

The New Middle East Cold War: Saudi/Israel/Lebanon versus Iran/Syria/Iraq/Hizbullah

http://www.juancole.com/2006/12/new-middle-east-cold-war.html

Post a Comment