By Bonddad

bonddad@prodigy.net

The first quarter of this year has not been good for the economy. I have written extensively about the housing market (simply do a search on my name and you'll see a plethora of articles). However, other numbers have come out that show activity is weakening on a variety of fronts. While we're not in a recession, we may be approaching one. And worst of all, inflationary pressures may prevent the Federal Reserve from lowering interest rates.

Durable Goods Orders Down 4 of the last 5 months

Durable goods are goods that last longer than 3-5 years. These goods are more expensive. Therefore, an increase in purchases is considered bullish and a decrease is considered bearish. These orders have decreased 4 of the last 5 months.

Here's a chart of the year-over-year change in durable goods orders. It does not include the latest number, which would send the red line into negative territory.

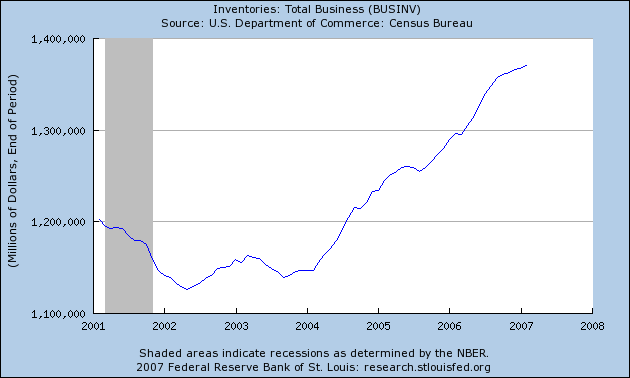

Increasing Inventories

Inventories are a tricky economic number to interpret. Because of improvements in supply-chain management, I would argue inventories are less important than in previous expansions. However, businesses have increased the amount of "stuff" they have on hand. This means a few things. First, a decrease in orders because businesses already have enough stuff to sell and use. In addition, it may also mean slower sales or an overestimation of sales increases. Either way, an inventory increase is a sign that future activity may decreaese.

Oil Prices and Supplies

Gas inventories have dropped sharply for the last few weeks and oil inventories are lower now than at the same time last year.

Gas prices are higher than this time last year.

For the eighth consecutive week, gasoline prices increased, rising 3.3 cents to 261.0 cents per gallon for the week of March 26, 2007. Prices are now 11.2 cents per gallon higher than at this time last year

Here's a chart:

What's particularly important about gas prices is their decrease at the end of last year helped to lower inflation. Now with prices increasing they will probably add upward pressure to CPI (see inflation below).

The GDP revision

4th quarter GDP was revised up, from 2.2% to 2.5% growth. But that's not exactly good news.

The increase in real GDP in the fourth quarter primarily reflected positive contributions from personal consumption expenditures (PCE), exports, state and local government spending, and federal government spending that were partly offset by negative contributions from residential fixed investment and private inventory investment. Imports, which are a subtraction in the calculation of GDP, decreased.

Non-residential fixed investment decreased 3.1% in the 4th quarter. While nonresidential construction increased .8%, investments in equipment and software decreased (-)4.8%. There has been some discussion about how business will react to the decreasing profit environment going forward. Some are speculating the business will decrease investment. the 4th quarter number indicates this may be correct.

Inflation

The latest CPI and PPI reports indicate inflation is not under control. While it's not out of control, it is above the Fed's publicly stated preferred level of 1%-2%. This means the Fed will either be boxed in from a policy perspective and be unable to lower interest rates, or they will lower rates with the possibility that inflation may increase as a result of their lowering rates. Either way, the Fed is not in a good place.

On a seasonally adjusted basis, the CPI-U advanced 0.4 percent in February, following a 0.2 percent increase in January. Energy costs increased 0.9 percent in February after declining 1.5 percent in January. In February, the index for petroleum-based energy increased 0.3 percent and the index for energy services rose 1.5 percent. The food index rose 0.8 percent in February, following a 0.7 percent increase in January. Grocery store foods rose 1.1 percent, largely reflecting a 4.7 percent increase in the index for fruits and vegetables. The index for all items less food and energy advanced 0.2 percent in February, following a 0.3 percent rise in January; an increase in the index for shelter accounted for about one-half of the February advance.

Bernanke made the following comments about CPI in his latest Congressional testimony:

Let me now turn to the inflation situation. Overall consumer price inflation has come down since last year, primarily as a result of the deceleration of consumers’ energy costs. The consumer price index (CPI) increased 2.4 percent over the twelve months ending in

February, down from 3.6 percent a year earlier. Core inflation slowed modestly in the second half of last year, but recent readings have been somewhat elevated and the level of core inflation remains uncomfortably high. For example, core CPI inflation over the twelve months ending in February was 2.7 percent, up from 2.1 percent a year earlier. Another measure of core inflation that we monitor closely, based on the price index for personal consumption expenditures excluding food and energy, shows a similar pattern.

Notice the attention Bernanke gives to energy prices, which have increased over the last few months. This does not bode well for future CPI readings.

The economy isn't in a recession....yet. But the bad news keeps mounting. There is only so much an economy can make.

For economic commentary and analysis, go to the Bonddad Blog

No comments:

Post a Comment