By Bonddad

bonddad@prodigy.net

Starting with Reagan in 1980, the Republican Party embraced and implemented "supply-side" economics. The central theory of supply-side economics was politically an easy sell: if the government cuts tax rates – especially on the wealthy – the wealthy will feel more inclined to earn more money. This will encourage the wealthy to make even more money. This will lead to higher tax revenue, which will more than offset the loss of revenue from the initial tax cuts. The central problem is no matter how you look at the results, they didn’t work as advertised.

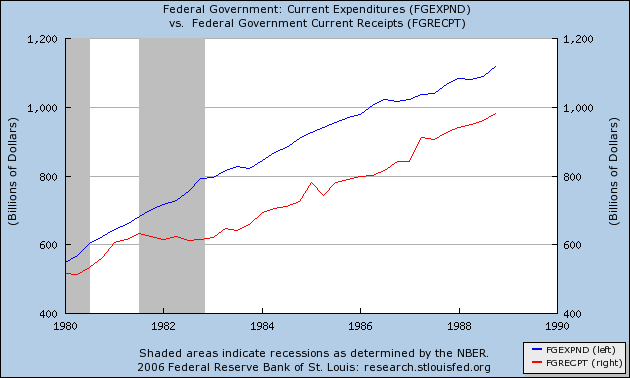

Reagan started the implementation in 1981, cutting upper-income taxes from roughly 70% to 50%. But a funny thing happened. Tax revenues were stagnant for 4 years from 1981 to 1984. For the years 1981-1984, revenues from individual taxpayers were (in billions) $285, $297, $288 and $298, (click on historical budget data) respectively. While the double-dip recession is partially responsible for the first two years, the economy came out of the recession November 1982. Yet for two more years, the rich didn’t feel unencumbered enough to increase their work efforts. At the same time, discretionary spending increased from $307 billion to $379 billion – an increase of 29%. This discrepancy between revenues and receipts then continued for the rest of Reagan’s presidency. Here is a chart from the St. Loius Federal Reserve that shows the discrepancy. Expenditures are blue and receipts are red.

There are three problems with Reagan’s overall economic policy. The first is the massive amount of debt he incurred for economic growth (which we’ll get too in a minute). The second was Reagan did not implement the other side of conservative fiscal policy – cutting spending. The third problem was the US did not achieve a super-human rate of national product growth. The median quarterly change in GDP during Reagan’s tenure was 3.85%. This is a good rate of growth. But the cost was substantial because to achieve this growth Reagan used debt which the US has not paid off.

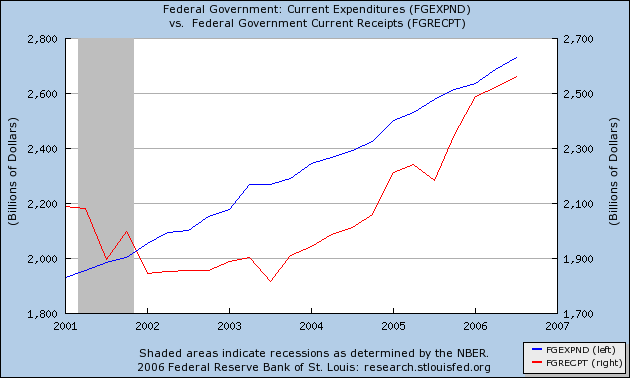

Bush 43 has attempted the same policy with the exact same result. Bush 43 has cut taxes twice. Yet revenue from individual taxpayers has not increased sufficiently to make-up for the loss in revenue. Revenue from individual taxpayers was $994 billion in 2001 and $1.08 trillion in the third quarter of 2006. However, Bush 43 has increased discretionary spending from $649 billion in 2001 to $967 billion in 2005. As a result, the gap between federal revenue and spending is similar to Reagan’s graph.

On the chart above, notice the scale for revenue on the right is $100 billion less per line than the expenditure line on the left.

As with Reagan, the US has achieved a good rate of economic growth, but hardly super-human in level. In short, as with Reagan’s economic plan, the growth achieved is insufficient to stimulate the economy to high enough levels to make-up for the loss in revenue.

The end result of all of this is simple: Reagan and Bush have mortgage our economic future with debt.

What makes this system even more sinister from a policy perspective is the issue of "rentiers". This is the fancy, eco-geek way of saying there are people who sit back and make money off of the current system without doing much except lobbying the government to maintain their benefits. In the current system, the US economy needs large pools of capital that will buy government debt to finance the economy. These people don’t really do much except collect principal and interest payments on the national debt. That’s their job and function in the US economy. Ever wonder why the Republicans were so interested in passing a capital gains tax cut? Now you know. The current national economic structure needs people who are willing to buy US debt. Therefore, we need to encourage that behavior with a tax code that benefits people who buy government bonds. The problem is this structure becomes self-defeating. As the government issues more debt, it needs more people to buy bonds. To do that, it continues to cut taxes to make government debt a more attractive investment, which in turn increases the use of debt to finance the US government. And around and around the cycle goes.

This also partially explains why the US can't take a stronger stand against China. China has routinely violated their WTO commitments on a host of fronts. However, the US needs the Chinese to buy US debt to maintain the American way of life. Hence, the US' over-reliance on debt makes it impossible for the US to use the "bully-pulpit" to challenge trade violations.

"So BD – why do you always harp on "supply-side" economics? We know it doesn’t work as advertised. Never has, never will." Here’s why I always harp on it.

The Republicans still believe in it.

They’ll find all sorts of ways to sell it, to make the basic facts fit their premise and to lie about it. No matter how many facts they encounter, they will find a way to make their dream theory come true. Since they list this election, they will return to their political roots, one of which is supply-side economics. And we have to beat them to the punch. We have to tell everybody until the whole country knows it’s a scam.

As the Democrats start to implement policy they will face tough choices regarding taxes, spending and government debt. And there are no easy answers to the questions they will face. The Republicans will jump in with their magic elixir of supply-side economics to make the problem seemly go away.

We have to prevent that from happening.

For more discussion on current economic matters, visit the bonddad blog.

No comments:

Post a Comment