By Bonddad

bonddad@prodigy.net

The financial press reported last week that the euro, the new currency created only five years ago and used by most European nations, has supplanted the U.S. dollar as the most widely used form of cash internationally. There are now more Euros in circulation worldwide than dollars.

This alone is not necessarily troubling, as the dollar remains the world’s most important reserve currency. About 65% of foreign central bank exchange reserves are still held in dollars, versus only about 25% in euros. And the European Central Bank faces the same inflationary pressures that our own Federal Reserve Bank Governors face, including a growing entitlement burden that threatens economic ruin as both societies age. European politicians want to spend money just as badly as American politicians, and undoubtedly will clamor to inflate-- and thus devalue-- the euro to fund their creaky social welfare systems.

Still, the rise of the Euro internationally is another sign that the U.S. dollar is not what it used to be. There is increasing pressure on nations to buy and sell oil in euros, and anecdotal evidence suggests that drug dealers and money launderers now prefer euros to dollars. Historically, the underground cash economy has always sought the most stable and valuable paper currency to conduct business.

This is what happens when supply-side economics and rampant "shop 'til you drop" consumerism is the dominant economic policy of a nation.

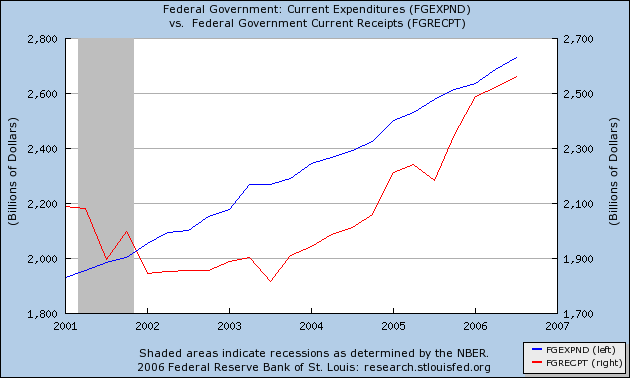

The US government has run massive fiscal deficits for the last 6 years. Despite the accounting tricks used to mask the deficit's true size, the Bureau of Public Debt reports that total outstanding debt on September 30 2001 was $5,807,463,412,200.06 and currently stands at $8,593,076,179,156.67 -- an increase of 48% in six years. At the same time, the US government has cut taxes and gone to war, which has increased discretionary expenditures over 30%. Here's a graphic representation of the "MBA President's" fiscal policy (the top line represents expenditures):

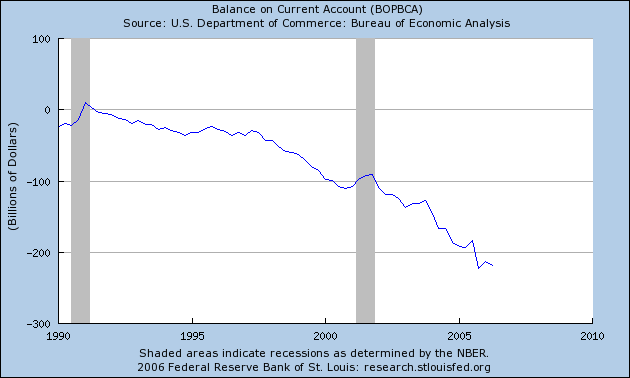

The US consumer has continually increased individual purchasing for some time. This has resulted in a mammoth trade deficit:

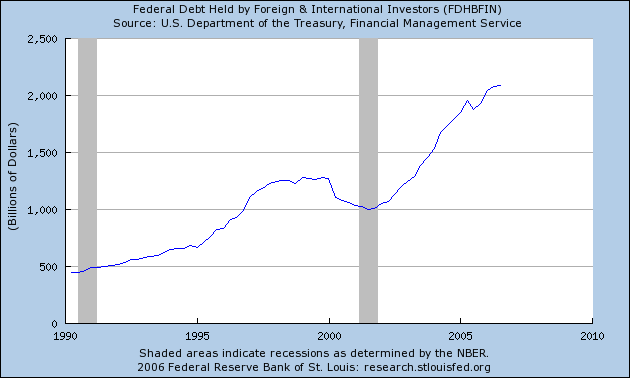

To finance this deficit, foreign governments have doubled their purchases of US Treasuries over the last 6 years:

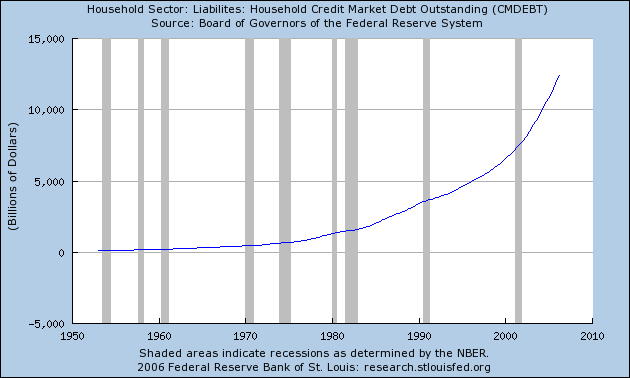

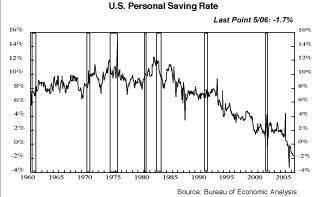

Instead of savings, the US consumer has gone into debt to finance US growth.

US Savings:

The end result of these policies is simple: Despite the many protestations of a "strong dollar policy" has come under continued assault in the currency markets. Here's an 8-year chart of the dollar.

A devalued dollar leads to several basic economic problems.

1.) The US Federal Reserve's ability to lower interest rates in the event of an economic slowdown is hemmed in. A devalued dollar means the US has a higher probability of importing inflation. The Federal Reserve is charged with price stability. If it lowers interest rates and the dollar is decreasing in value, it may import inflation.

2.) The possibility of the dollar being shocked be a random economic event are higher. Consider that over the last few weeks Thailand implemented draconian currency controls that sent its markets down 10% in a day. While the government reversed policy within 24 hours, if they hadn't have done so, it is possible the effects would have eventually bled over into the dollar.

3.) Right now foreign central banks are playing a giant international game of chicken. No one want to see their official reserves decrease in value. So, they all want to slowly sell dollars and buy more euros. However, by selling dollars they may create a selling panic that further decreases their respective currency reserves. In the current environment the possibility of one government making the wrong move is higher simply because of the dollar's precarious valuation.

No comments:

Post a Comment