Did Elaine Chao Let An Influential Right Wing Group Steal Taxpayer Money?

by PaulVA

phpimen@comcast.netFeb 08, 2007

Elaine Chao, wife of Senate Minority Leader Mitch McConnell and George's Bush's Secretary of Labor has been ignoring requests to investigate 19 chapters of the Associated Builders and Contractors for tax fraud.

Of course, this same group, the Associated Builders and Contractors just happens to be a major donor not only to Republican campaigns but also to Chao's husband, Mitch McConnell. This group quite possibly used taxpayer money from state apprenticeship and training grants to help finance local chapter activities which include lobbying for its conservative, anti-worker free market causes.

(This research was not collected by me. it is the result of a two year crusade by Allen Smith, a researcher formerly with the Building and Construction Trades Department. Though it was released earlier to the press, it never really was widely covered by the "liberal media.")

Before beginning, it might be a good idea to get some background on just who this group is and what they represent.

Just Who Is The Associated Builders and Contractors?

The Associated Builders and Contractors (ABC) is a virulently anti-worker business group whose mission statement leaves little to the imagination:

ABC's mission is the advancement of the merit shop construction philosophy, which encourages open competition and a free-enterprise approach that awards contracts based solely on merit, regardless of labor affiliation.

You probably never heard of it, but the group's influence in the halls of Washington is powerful. Bolstered by members such as Halliburton's Kellog Brown and Root, this group of free market enthusiasts is ranked by Fortune Magazine as one of the 50 most influential groups in the nation.

This group currently stands as one of the leading opponents of the minimum wage increase, Employee Free Choice Act, Project Labor Agreements, Best Value Construction Contracting, and overtime pay, amongst other things.

Fraud With Taxpayer Dollars

While the Associated Builders and Contractors tout their free market philosophy, they seem to have no problem with relying upon taxpayer dollars to fund their "so-called" training programs which have come to serves as nothing but a means of perpetuating a potentially illegal bait and switch scheme.

The fraud stems from an examination made of the annual financial reports filed by the ABC's individual chapters and their local apprenticeship and training entities. Each of these reports, known as a Form 990, is required by the IRS of almost all non-profit organizations.

These 990 forms require the disclosure of all compensation payments to officers, key staff and board members of these groups - even if the payments are made indirectly through a third party firm. Groups operating as non-profits under these guidelines must also report all transactions made with other related non-profit groups.

The related non-profits in this case are each chapter's Apprenticeship Trust which are a separate training organization administered under seaparate funds to provide training for workers looking to train for a career in the construction industry.

Originally developed by early craft unions, every modern construction union has one, paid for by a mix of employer and employee donations that pay for training equipment, instructors, and a battery of refresher courses to assist union members in updating their training to meet new technological demands. These have worked successfully over the years resulting in a high retention rate without the reliance on taxpayer funds.

The ABC, through its local programs, however, reveals a different story that is being ignored by the very people appointed to oversea fraud in the construction industry and in training.

The report written by Allen Smith from the AFL-CIO's Building and Construction Trades Department details a history of potential fraud which the Department of Labor has failed to investigate. This fraud has been running rampant within individual chapters across the country:

Where Did Payments From the ABC's Alabama Training Arm Go To?

Between 1998 and 2002, the ABC of Alabama Apprenticeship Trust paid $304,984 to the Chapter for "reimbursement of expenses." However, the Chapter failed to report receiving any such money as income between 1999 and 2002

Source: Building And Construction Trades Department

Which insider received a loan from the Southern California Chapter and what were the terms?

In 2001, the Chapter listed a $54,102 receivable from an officer, director, trustee, orkey employee. In 2002, the amount had increased to $57,870. The terms of anyinsider loan must be disclosed in a schedule, but no schedule was included in theforms provided by the IRS for either year.Source: Building and Construction Trades department

Why did the Indiana Apprenticeship Trust make false statements about its salaries and contractor payments?

All five reports filed by the Trust for the period between 7/1/97 and 6/30/02 claimedthat the Trust made no payments to any key employees. All five stated that no staffmade over $50,000 a year. All five stated there were no payments of over $50,000 toany contractors for professional services. All five stated the Trust made no paymentsto any related non-profit. All five stated that no related non-profits even existed.In the five years, the Trust made the following payments without disclosing whoreceived the money, even when they were above the $50,000 IRS disclosure limit.• $889,465 for "purchased staff time."• $376,542 in "rent" with increases from $12,466 in 1997 to $146,795 in 2001.• $261,268 to a "training facility."

Disappearing Funds In Michigan

According to the Department of Labor, the Michigan ABC's Training Trust received state funding for training 294 students in 2002. Trust filings show that the group only trained 155 students between 1995 and 2002 - with 102 dropping out. So where did all the state funding for this program go? Perhaps to the local ABC Chapter for lobbying and political activities?

In 2002, the Chapter spent $87,457 on salaries and wages. In the same year, theTrust spent $265,909 on salaries and wages. The large difference in salary and smallnumber of apprentices reported by the Department of Labor raises the question ofwhat the staff paid for by the Trust were actually doing. In addition, bothorganizations failed to provide required information on the compensation provided tokey employees. Among the people whose names, titles, and salaries should havebeen disclosed are the Chapter’s Executive Director and the Trust’s Director of Education.

Source: Building and Construction Trades Department

Funneling State Work Training Money Back To A Black Hole or Maybe to the GOP?

An August 8, 2003 issue of the National ABC's Newsline boasts that the Nevada apprenticeship program received a $202,403 grant under the Workforce Investment Act to train plumbers. However, the program only enrolled only 380 apprentices and graduated 92 while in 2000, the apprenticeship training program sent $130,141 for expenses while the chapter reported on only $48,000. Where did the other $82,000 go?

Did the Ohio Valley Apprenticeship Trust Private Foundation Funnel Tax Exempt Donations to the Group's Lobbying Arm?

It seems so. Between 1999 and 2002, the Apprenticeship Trust's Foundation raised $441,820 in public donations. Because the apprenticeship program's charity foundation is a 501(c)(3), contributors can take a tax deduction for their contributions.

During that same time, $779,650 in "administration fees" were sent to a series of undisclosed outside contractors. At the same time, the local ABC Chapter, which lobbies on political issues, recieved contributions similar to that amount in the total of $695,000 listed as "educational trust fees." And you though the mafia was good at money laundering.

The cold, plain hard truth is that the ABC apprenticeship programs seem to operate as a sham to divert taxpayer money into political, lobbying, and organization-building efforts.

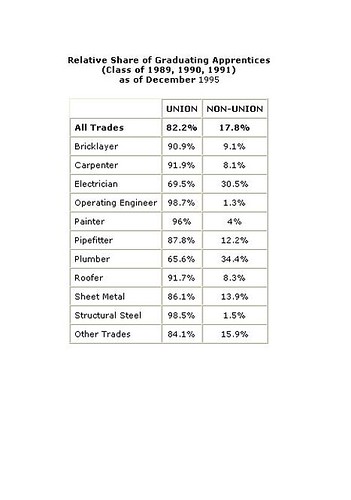

The graduation rates for those apprentices unlucky enough to have been ennrolled is these programs is miserable, as noted in the chart below.

What are the chances of a response from Elaine Chao? Probably not good, but who knows with the rise a new Democratic Congress.

When searching for a response from, Elaine Chao, the best I could find was this article about it from a union electrical contractors' website:

A DOL spokesman April 20 said the petition has been received by the department where it "is being reviewed to see if it has any merit."

The Building Trades petition was filed one month after U.S. Senators Edward M. Kennedy (D-MA) and Patricia Murray (D-WA) asked the General Accounting Office to investigate the performance of the nation’s construction apprenticeship programs, including graduation rates, the duration of training, and wage levels for apprentices during their training and upon their graduations.

DOL and GAO have remained silent on that request, as well.

It is sad that the people charged with enforcing our labor and tax laws remain silent over an apparant rip-off of taxpayer funds. Even worst, they do this in support of a group that has virulently opposed worker protections in the workplace, including the freedom of an employee to choose a union of their own.

Somebody needs to make them accountable.

No comments:

Post a Comment